Should you itemize or take the standard deduction?

We all prefer to pay as less taxes as possible. Fortunately, the IRS does allow taxpayers to take deductions which reduce our amount of taxable income. The two primary options the IRS offers taxpayers are Itemize Deductions and the Standard Deduction. Itemized deductions depend on the amount of deductible expenses a person incurs throughout the year. The Standard Deduction is a predetermined amount set by the IRS.

When you file taxes, you have to choose one of the two deduction options offered by the IRS. You can choose to deduct itemized expenses, or you can take the standard deduction. It must be either or. You CANNOT take the standard deduction AND still write off itemized expenses.

Standard Deduction

The standard deduction is a predetermined deduction amount set by the IRS but it varies depending on your filing status. For the 2022 tax year, the standard deductions are as follows:

Single/Married filing separately – $12,950

Head of Household – $19,400

Married filing jointly – $25,900

Itemized Deduction

Itemized deductions are expenses that you pay throughout the year that the IRS classifies as tax deductible expenses. Itemized deductions include the following:

Medical and dental expenses

State and local income taxes paid

State and local real estate taxes paid

State and local personal property taxes paid

Mortgage interest paid

Gifts to qualified charities

Casualties and losses within a federally declared disaster area – meaning the President declared a federal emergency for the area you live during the tax year.

Do I Itemize or Take the Standard Deduction?

The decision to choose between itemizing deductions and taking the standard deduction is a no-brainer for most people because it comes down to simple math. Which option will give you the greatest tax deduction?

Example:

Monica is 30 years, single with 0 dependents. Her standard deduction is $12,950.

Monica’s expenses that qualify for an itemized tax deduction are as follows:

Mortgage interest – $7,200

Property taxes – $2,500

Both mortgage interest and charitable contributions are itemizable expenses. However, these two expenses total only $9,700. Since Monica’s standard deduction is $12,950, it would not make sense for her to choose Itemized Deduction because she’ll receive a bigger tax benefit from the Standard Deduction.

It does makes sense to itemize when the total amount of your itemized expenses exceeds the standard deduction.

Example:

Suppose Monica’s expenses were:

Mortgage interest – $7,200

Property taxes – $2,500

Charitable contributions – $4,000

The mortgage interest, property taxes and charitable contributions total $13,700 which is more than the $12,950. In this scenario, Monica would benefit more from itemizing deductions because it gives her the largest tax deduction.

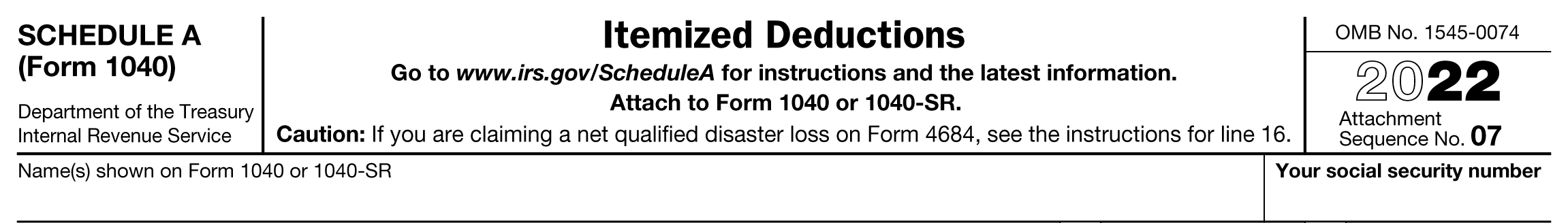

Claiming Itemized Expenses

Itemized deductions are reported on Schedule A. You simply enter all your qualified expenses into the form and calculate the total. Maintaining good records is crucial for accurately reporting your itemized deductions. For example, to know whether you qualify for the medical expense deduction you would need to maintain a copy of all your medical related expenses for the year so that you can add them all up.

Do you have a tax question or need to schedule an appointment with a tax professional?

Need a tax professional to make sure your taxes are filed correctly?