Credits vs Deductions

I have never met anyone who likes paying taxes. Fortunately, there are provisions in the tax code to reduce the amount of our income that gets taxed. This is done by way of tax deductions. If that’s not music to your ears, there are also provisions to reduce the amount of tax we owe. This is done by way of tax credits.

Deductions

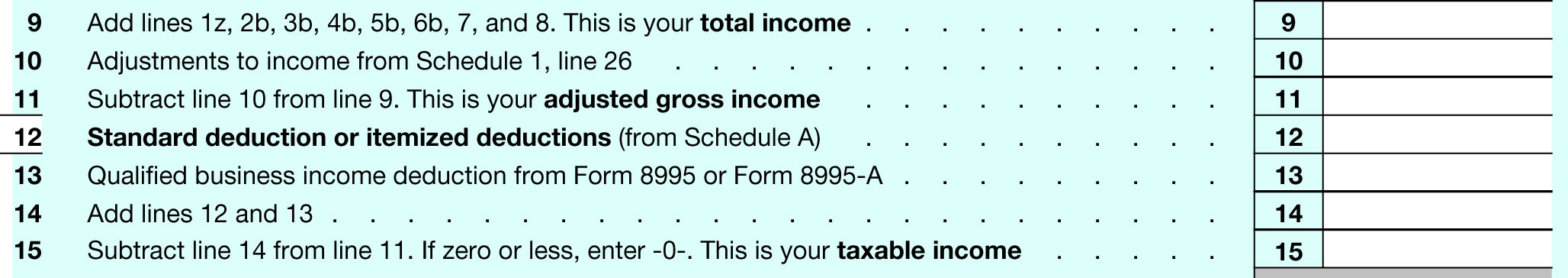

Deductions are items/expenses that reduce the amount of your taxable income.

Notice in the image above. Line 9 represents a person’s total income. Lines 10 & 12 represent deductions that reduce that total income.

Credits

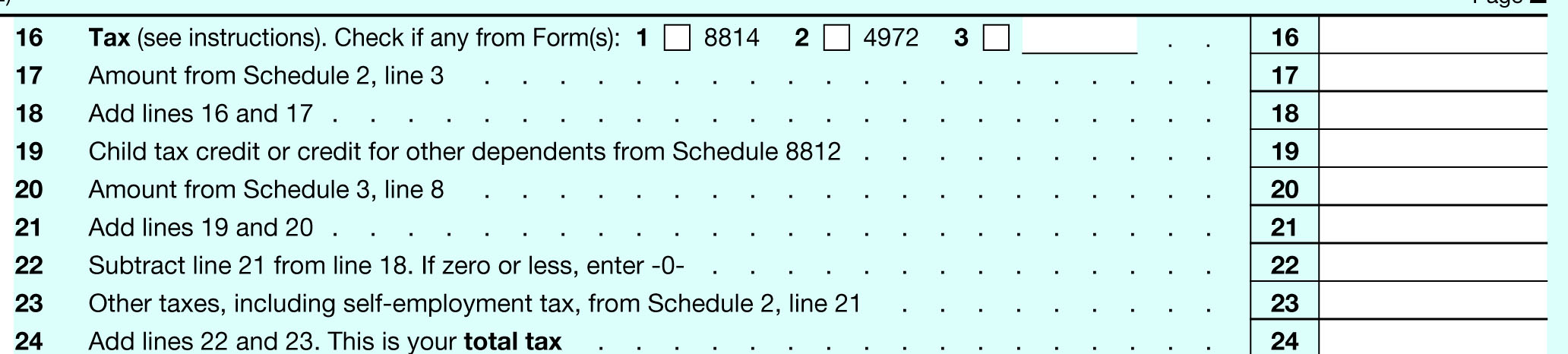

Credits are items/expenses that reduce the amount of tax you owe on the income you earned.

Once our taxable income is calculated, we use the IRS Tax Tables to determine how much tax we owe. However, if you have eligible tax credits you can use those to reduce the amount of tax you owe.

Notice in the image below, Line 16 represents the amount of tax owed. Lines 17 – 23 represent various tax credits that can be subtracted from the amount owed on Line 16. After all the applicable credits are subtracted your reduced tax liability is entered on Line 24.

Non-refundable vs Refundable Credits

Tax credits fall into two categories. Refundable and non-refundable. Non-refundable credits allow someone to receive a tax credit up to the amount of their tax liability. For example, if someone qualified for a $1000 non-refundable tax credit but their tax liability was only $500. They would only be able to use $500 of that tax credit.

Non-refundable credits include:

Adoption credit

Foreign tax credit

Mortgage interest tax credit

Credit for the elderly and disabled

Electric vehicle credit

Refundable credits allow taxpayers to receive credit beyond the amount of your tax liability even if it results in them receiving a tax refund. For example, if someone qualified for a $1000 refundable credit and their tax liability was $500. They would use the full credit and receive a $500 tax refund.

Refundable credits include:

Child tax credit

The earned income tax credit

The child and dependent care credit

The savers credit

Updates on Deductions and Credits for 2022

The Covid stimulus bills temporarily boosted some of the deductions and credits for 2020 and 2021. However, some of these deductions and credits have expired and returned to previous levels for 2022.

The Child Tax Credit was up to $3,600 per dependent in 2021. For 2022 it is back to $2000 per dependent

The Earned Income Credit for taxpayers with no dependents was up to $1500 in 2021. For 2022 it is back to $500.

The Child and Dependent Care Credit was up to $8000 in 2021. For 2022 it is back to $2,100.

There was a provision in the Covid bill for taxpayers to take up to a $500 Charitable Deduction without itemizing. For 2022, that provision has expired. Only those who itemize deductions are eligible to deduct charitable contributions.

For a full list of IRS credits and deduction click here.

Do you have a tax question or need to schedule an appointment with a tax professional?

Need a tax professional to make sure your taxes are filed correctly?