The tax filing status you choose when filing your tax return has an impact on your money. Filing status determines the amount of the Standard Deduction you’re able to claim on your return. It also determines the amount of tax you pay on any given level of income.

What are the filing status options?

There are five filing status options to choose from.

Single – for unmarried, divorced and legally separated individuals.

Head of Household – unmarried individuals with a qualifying dependent

Married Filing Joint – married couples who file together.

Married Filing Separate – married couples who file separately.

Qualifying Widow or Widower with Dependents – individuals who lost a spouse within the last two tax years.

How Filing Status Affects Your Taxes

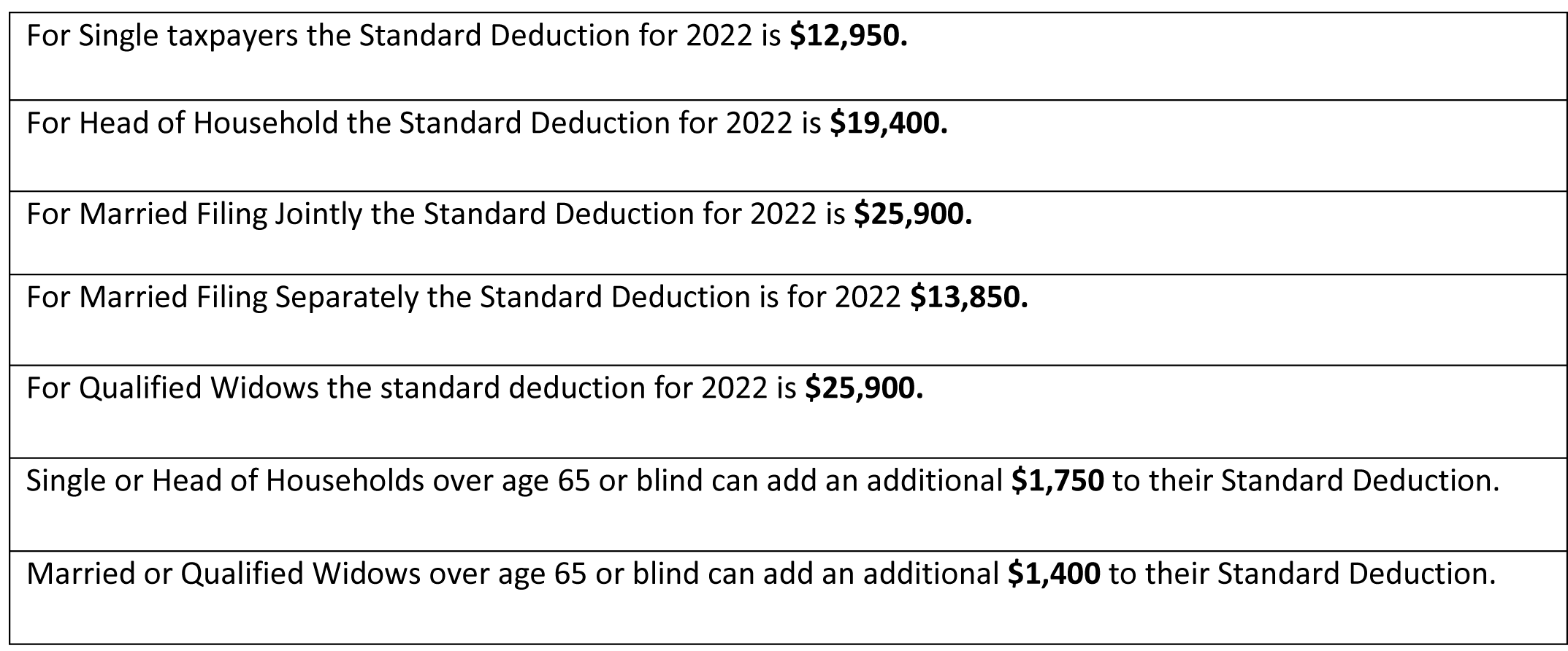

The Standard Deduction varies based on your filing status.

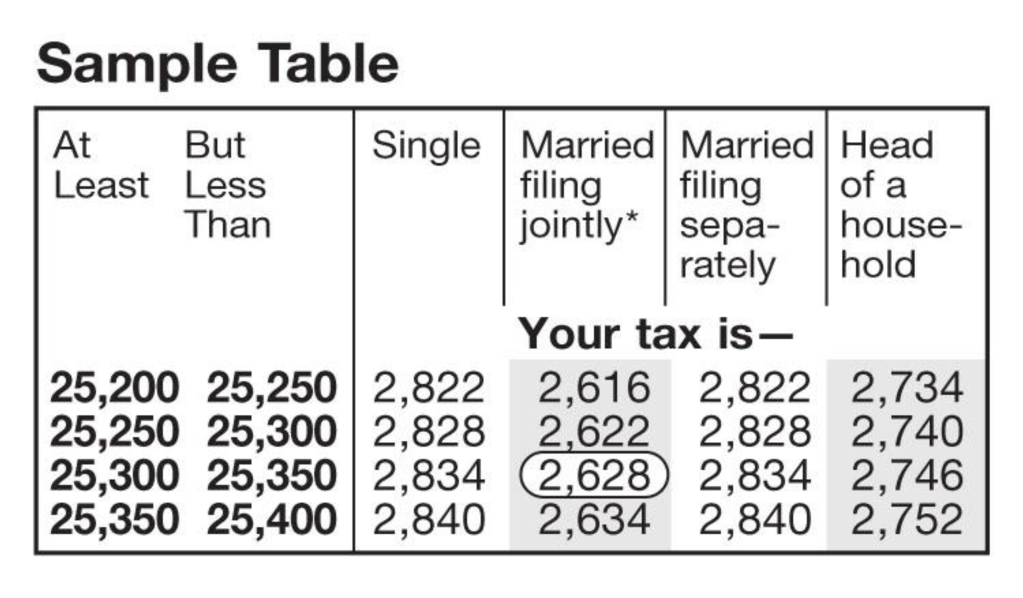

The amount of tax due at any given level of income also varies based on filing status.

How to Choose the Proper Tax Filing Status

How to Choose the Proper Tax Filing Status

Your tax filing status is determined by your status on the last day of the year.

Examples:

If you had a baby on December 1, 2022, you’re considered to have had a dependent for all of 2022 and are eligible to claim Head of Household as your Filing Status.

If you were single and got married on December 1, 2022, you’re considered to have been married for all of 2022 and eligible to claim Married Filing Jointly as your filing status.

Choosing the Most Beneficial Filing Status

Obviously, if someone is single with no dependents, there’s only one filing option available to them and that’s Single. However, for anyone who has dependents, is married, or both married and has dependents, they have the option to choose one of several different filing statuses.

Examples:

If you’re single with dependents and maintain the household where you and your dependents live, you have the option of filing Single or Head of Household. The Standard Deduction for Head of Household is larger than the Standard Deduction for Single so assuming you meet all the qualifications, Head of Household would be the most beneficial filing status.

If you’re married, you have the option of filing jointly or separately. Married Filing Jointly offers a larger Standard Deduction than Married Filing Separately. Unless there are specific reasons to file taxes separately, couples who choose to Married Filing Separately are leaving money on the table.

Not sure what your tax filing status is? Verify it here.

Do you have a tax question or need to speak with a tax professional?

Need a professional to make sure your taxes are filed correctly?