Income we receive gets taxed based on the way that income is classified by the IRS. The IRS determines that classification by the way the money is derived. For tax purposes, income is classified into two categories: ordinary income and capital gains.

Ordinary Income Tax

Ordinary income is money earned through wages/salaries, tips, rent, prizes, commissions, dividends, interest, and unemployment. Interest and dividends received are also taxed as ordinary income.

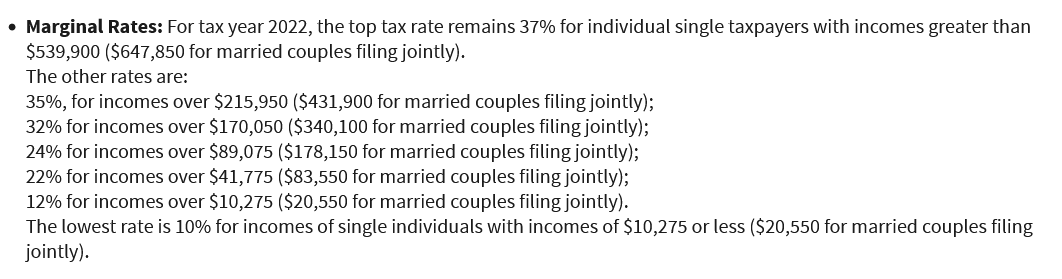

Ordinary income is taxed based on marginal tax rates established by the IRS. The table below displays the various rates that regular income is taxed by income level.

Ordinary Income Tax Rates

Capital Gains Tax

A capital gain is profit generated from the selling of an asset for more money than you initially paid for it. For example, if you purchase a home today for $200,000 and sell that home 5 years from now for $250,000. You received a $50,000 capital gain.

Capital gains are taxed either at short-term capital gains rate or long-term capital gains rate. Short term means you owned the asset less than 12 months. Long-term means that you owned that particular asset longer than 12 months.

Short-term capital gains are taxed at your highest marginal tax bracket. Referring to the chart above, if a single person earning $90,000 sold an asset that they owned for less than 12 months, the profits from that sale would be taxed at 24%.

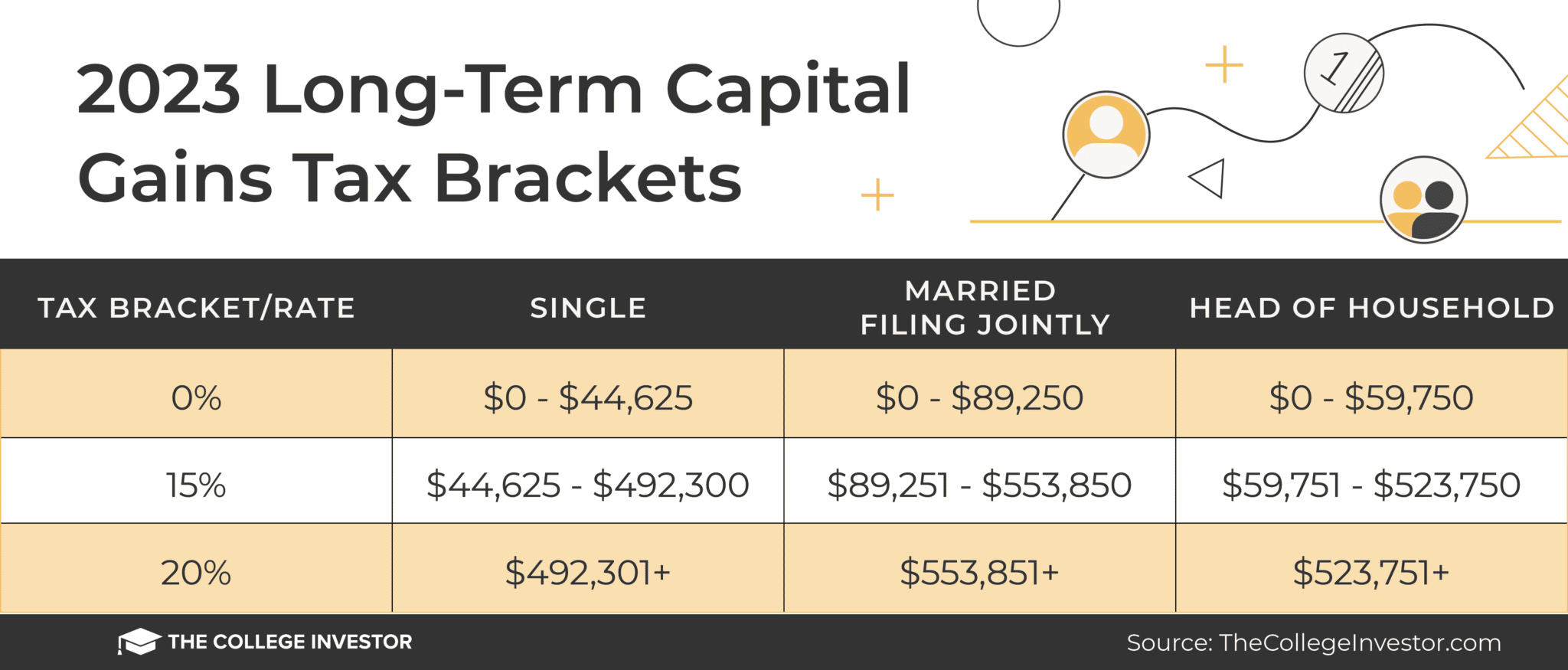

Capital Gains Tax Rates

Long-term capital gains are taxed at either 0%, 15, or 20%. The amount of the tax depends on the individual’s tax bracket.

0%

If you’re single and your income is less than or equal to $41,675 your long-term capital gains tax rate is 0% If you’re married filing jointly and your income is less than or equal to $83,350 your long-term capital gains rate is 0%.

15%

If you’re single and your income is greater than is more than $41,675 but less than or equal to $459,750, your long-term capital gains rate is 15%. If you’re married filing jointly and your income is greater than $83,350 but less than or equal to $517,200 your long-term capital gains rate is 15%.

20%

If you’re single and your income is greater than $459,750, your long-term capital gains rate is 20%. If you’re married filing jointly and your income is greater than $517,200, your long-term capital gains rate is 20%

Do you have a tax question or need to schedule an appointment with a tax professional?

Need a tax professional to make sure your taxes are filed correctly?