Most IRS qualified retirement plans allow you to make your retirement contributions as either Traditional contributions or Roth contributions. The question that comes up often is, is it better to make Traditional or Roth retirement contributions. My initial response to this question is usually the same, “it depends.”

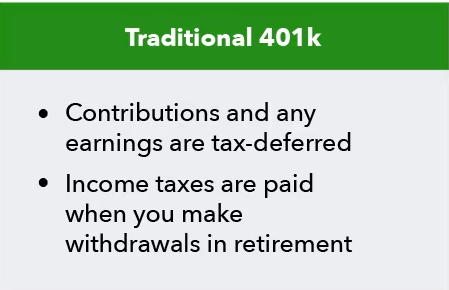

Traditional Contributions

Traditional retirement plans allow you to make contributions to your retirement account using pre-tax dollars. Traditional contributions come out of your gross pay and go directly into your retirement account. The money is not counted as income to you in the current year because you did not actually receive the money. It went directly into your retirement account. The money will be counted as income to you and taxed at the time you withdraw it during retirement.

Example:

Let’s say someone had $1,000,000 in their retirement account and all their contributions were Traditional. Although the value of their account is $1,000,000, they won’t receive the full $1,000,000 because taxes with be withheld from everything that they withdraw from the account.

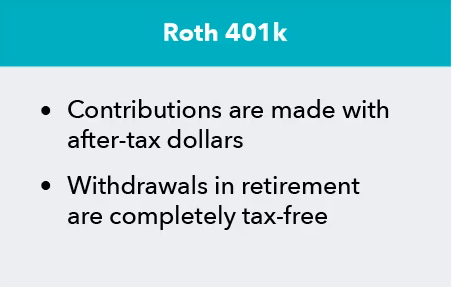

Roth Contributions

Roth retirement plans allow you to make after-tax retirement contributions to your retirement account. Roth contributions come out of your net pay and go directly into your retirement account. The money is taxed as income to you in the current year and it will not be taxed again when you withdraw it during retirement.

Let’s say someone had $1,000,000 in their retirement account and all their contributions were Roth. The entire $1,000,000 belongs to them because they paid taxes on the income at the time of contribution.

Which is Better?

Now back to the question, which is better, As I said, it depends. The decision to make pre-tax or after contributions depends on your current tax bracket and your anticipated tax bracket in retirement.

Current Tax Bracket

It’s also important to consider your current top tax bracket. If part of your income touches a high tax bracket, you will likely save yourself some money in tax by allowing part of that income to be differed and taxed in retirement instead of right now. On the other hand, if your income falls within a low tax bracket, you benefit more by paying the tax now and not having to worry about taxes at all later. For more information on tax brackets click here.

Future Tax Bracket

This is not as straightforward as current tax brackets partly because we don’t know what future tax brackets will look like. They could be pretty much the same as they are now, or they could be much different. What you should have a pretty good idea about is what your anticipated level of income would be during retirement. If that anticipated level of income is less than what you earn right now, then its more favorable to have the money taxed during your retirement years than it is to have it taxed now. If your anticipated level of income is more than you earn now, then its more favorable to have the money taxed now in instead of your retirement years.

Do you have a tax question or need to schedule an appointment with a tax professional?

Need a tax professional to make sure your taxes are filed correctly?